Something to consider in a sellers’ market

Inventory is at an all-time low right now. For instance, there are only 48 houses actively on the market in Bartow County priced at $400,000 or below. That number drops to 28 houses at under $300,000 and it is nearly impossible to find anything for sale under $200,000.

That’s not a lot of houses for an entire county.

Whitfield County has a little more with 53 houses for sale under $350,000. That number drops to 49 houses under $300,000 and then to 32 under $250,000.

Gordon County has 48 houses … total. Houses priced under $300,000 are 33 and the number below the median sales price of $215,000 drops inventory to only 19 houses.

That’s not a lot of houses y’all. So, with that low inventory and strong demand, competition has ensued.

This is great if you are a seller because buyers are competing for your property. Not only are sellers getting what they are asking, but they are often getting over list price. And since buyers are having to compete with each other, they have started making their offers stronger and more creative. We have buyers now asking for zero in contributions from the seller, foregoing a due diligence period and even adding an escalation clause that states they will beat the highest offer by $1,000 up to a certain price.

But be mindful of these offers and think them through before you accept. They may not be what they seem.

For instance, I was talking to a buddy of mine recently, and he told me about a buyer who made an offer that included $2,500 in earnest money and an escalation clause that topped out at $25,000 over the list price. But the buyer put some pressure on the seller and required acceptance within a short period of time. The seller did accept, and they went under contract for a premium price.

Here is the thing though, the buyer had never been to the house. They were just throwing out offers trying to get something under contract because they had been beaten on so many houses before. But once the actually went into the house, they decided it was not a good fit, and cancelled the contract during the due diligence period.

To me this was just wrong. The seller lost valuable time on market and could have missed a real buyer. Plus, the house’s reputation could have been tainted because a would-be buyer might have wondered why the previous contract fell through.

That story got me wondering how the seller could have prevented someone who wasn’t serious from tying up their house.

One way they could’ve controlled it would have been through option consideration.

I don’t know if you realize this, but the Georgia Association of Realtors (GAR) Purchase and Sale Agreement (PSA) is nothing more than an option contract. We don’t normally think about it, but if you read the GAR PSA well, you will see that the seller is granting the buyer the right — but not the obligation — to purchase a piece of property within a specified period. That is what an option contract is. As a matter of fact, there is no section of the GAR PSA that gives the seller the ability to terminate. It only gives that power to the buyer, which is common in an option.

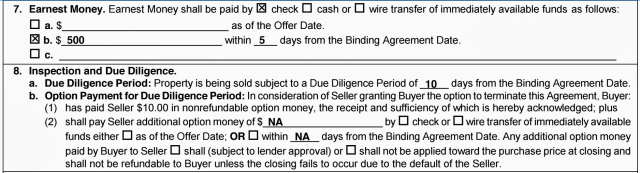

In section 8, paragraph b of the GAR PSA, it even talks about option consideration, that can be non-refundable, being paid to the seller in return for granting the buyer the “option” to terminate.

Now, suppose the seller in the above scenario countered the original offer and said they were willing to accept only $10 of earnest money but $2,500 in non-refundable option consideration which had to be paid at the signing of the agreement.

Do you think that would keep a frenzied buyer from making an offer that they did not intend to close?

I can’t say for certain, but it would be a great deterrent. And even if the buyer did terminate, the seller would have a little something to compensate them for the time and effort they expended as their house spent time off market. And even though we are in a sellers’ market, using the option portion of the GAR PSA is something you should consider when lots of offers come in.

Joe and Ashley English buy houses and mobile homes in Northwest Georgia. For more information or to ask a question, go to www.cashflowwithjoe.com or call Joe at 678-986-6813.