Earnest money can be defined as a good faith payment made by a buyer at the time of entering a contract to indicate their intention and ability to carry out the contract to the seller.

Once upon a time, earnest money demonstrated the buyer’s commitment to purchasing the house and it was given directly to the seller to hold until the contract closed. At that time, it would be applied to the purchase price.

If the buyer didn’t perform in this situation, the seller kept the earnest money as satisfaction of any liquidated damage they may have incurred.

You may be wondering what kind of damages a seller may incur while waiting for a sale to close. Let me give you an example of a deal that just fell through to help you understand where we lost a buyer after being under contract for an entire month.

Basically the buyer couldn’t get a loan because they falsified their loan documents saying they’d been renting from family. Instead, they’d just been living at home helping out. This sort of situation doesn’t count as a tradeline to establish their credit for a mortgage.

Once we found out they couldn’t get a loan, the buyers’ agent sent us a termination agreement that read the buyer should be returned their earnest money.

So where were the losses in this situation?

The buyers’ agent and the mortgage broker lost because they’ll never be compensated for the time and effort they put into this deal. They literally worked for free. Consequently, the listing agent’s pay day was postponed.

But what about the seller – what did we lose?

We lost an entire month of advertising our property to potential buyers who could actually get loans. We incurred an entire month’s worth of interest at hard money rates. We paid for the lights and water to be on, to insure the house and for the grass to be cut all month.

Of all the parties involved, we’re the ones who paid out real dollars as opposed to just losing a future payday.

These are the kinds of damages a seller incurs when a buyer doesn’t perform. These are real costs that we’ll never be compensated for since we didn’t receive the earnest money.

When you enter into a contract, both the buyer and seller give up something. The seller gives up the right to pursue other buyers and the buyer, presumably, gives up the right to their earnest money should they not perform under the terms of the contract. However, the way the Georgia Association of Realtor’s Purchase and Sale Agreement (GAR PSA for short) is written offers buyers ample opportunity to terminate with no penalty. This means the seller rarely receives the earnest money, even if the buyer fails to perform well past the due diligence period.

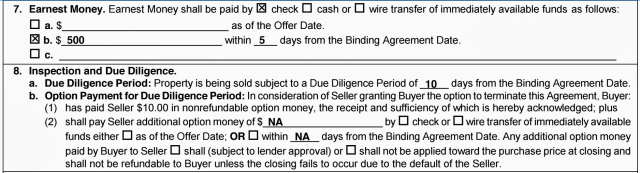

That being said, something was added to the GAR PSA this year that can circumvent this issue. Section 8.b.2 states:

“(Buyer) shall pay Seller additional option money of $_______ by check or wire transfer of immediately available funds either as of the Offer Date; OR within _____ days from the Binding Agreement Date. Any additional option money paid by Buyer to Seller shall (subject to lender approval) or shall not be applied toward the purchase price at closing and shall not be refundable to Buyer unless the closing fails to occur due to the default of the Seller.” (I think adding “or if the contract is terminated during the due diligence period” here would make this even handed.)

Utilizing this section, a seller could legitimately receive a good faith payment from a buyer demonstrating their intention and ability to carry out the contract. Since the option money paid here is non-refundable, the seller will have assurance knowing they will be compensated should the buyer not perform. This will make for a more serious buyer which means less dropped contracts and less agents and brokers working for free. Isn’t that a great scenario?

Joe and Ashley English buy houses and mobile homes in Northwest Georgia. For more information or to ask a question, go to www.cashflowwithjoe.com or call Joe at 678-986-6813.