A/C Repair Yields Over 31 Percent:

Financial calculators aren’t normally a hot topic, even in real estate circles, but I took the opportunity to attend an information session on the subject sometime ago, and I haven’t regretted it.

The instructor’s name was Gary Johnston, and the night of the session, he forever changed the way I look at investments by introducing me to the financial calculator. Consequently, I went on to attend his three day-seminar called “Financial Principles”.

I know what you’re thinking: “Three days of running numbers through a calculator?”

Trust me, once you go, you’ll understand. It’s not about crunching numbers and figuring out mortgage payments. It’s about learning to ask “if I spend my money on this, will it grow? If it does, how much will it grow, and how fast?”

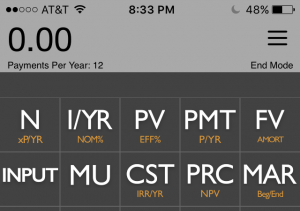

Let’s look at a real deal, and I’ll show you how to do some calculations. I recommended using an app called the “10bii Financial Calculator.” It’s available for iPhone and Android.

(Note: Visit our blog on this one. I’ll put up screen shots of the calculator so you can see what it look’s like filled out.)

At the top of your calculator, you’ll see five buttons: N, I/YR, PV, PMT, and FV. Each button stands for a piece of information you’ll need to do a calculation. If you know four pieces of the information, you can find the fifth.

Here’s what each button stands for:

N: number of payments (in months),,, I/YR: interest/ yield,,, PV: present value of the loan or investment,,, PMT: payments and FV: future value.

For most real estate calculations, FV is zero; that’s because most mortgages will be paid off in the future. Now we have one piece of information for our example. Let’s go find the others.

The deal I want to look at is a single wide we bought on an acre of land for $15,000. That means the present value is negative $15,000. It’s negative because it’s money that we paid out. (In the financial calculator world, money you pay out is negative while money paid to you is positive. If you get that wrong in PMT and PV, the calculator will give you an error).

That house rents for $425 a month. Those are payments made to us which makes PMT a positive number.

Let’s look and see how well this investment performs over eight years. We have N, PV, PMT and FV. We want to find I/YR. The values look like this:

N=96 (8 years); I/YR= ?; PV= -15,000; PMT= +425; FV=0.00

I/YR equals 31.08 percent!

Now you’re thinking “That’s an awesome return, but I thought we were going to talk about A/Cs.”

Here’s how they factor in: when we got back from Gary’s course, we were rehabbing the previously-described deal. The house had no A/C, so I called my repairman to ask how much central would cost. He said he could do it for $1,500.

I didn’t want to spend that. But with central A/C, we could get an extra $50 a month in rent.

Armed with the knowledge Gary gave us, we can put it into the calculator. PV is the cost of the A/C, PMT is the extra rent and FV is zero. To find I/YR, We’ll need to assign a value to N. It’s reasonable to assume you can get eight years out of a new A/C with no repairs. So:

N=96 (8 yrs); I/YR= ?; PV= -1,500; PMT= +50; FV=0.00

So I/YR equals 37.99 percent!

Suppose the A/C went bad in five years?

N=60 (5 yrs); I/YR= ?; PV= -1,500; PMT= +50; FV=0.00

Even then, this deal still yields 31.58 percent! And we just demonstrated how a repair can be perceived as a deal.

That’s what Gary can do for you. He can teach you to see deals in places you never would’ve looked before. To see his seminar schedule, check out GaryJohnston.com.

Joe and Ashley English invest in real estate in Northwest Georgia. For more information or to ask a question, go to www.cashflowwithjoe.com